Investors would be better off using this strategy during uncertain market conditions

Long short strategy is a hedged trading strategy in which the investor goes long in one stock or index and at the same time goes short in the other stock or index to minimise the risk by hedging the position. The investor goes long in the script or index he is more bullish on and shorts the other one to hedge his position. For the perfect hedge, the size of both the positions should be identical. This strategy is popularly used by the hedge fund managers to maximise returns on their investments by reducing risks through hedged trades.

This strategy yields positive returns to the investor when the long position outperforms the short position absolutely or even relatively. By adopting this strategy, the fund manager minimises his exposure to the broader market and profits from the change in the spread between two scripts.

This strategy can be used during difficult and uncertain trading environments like the current one, where the overall market trend is uncertain and volatility is extremely high. This strategy can be used on stocks as well as broader indices. The strategy when used for trading in indices eliminates individual stock specific risks as individual stocks are more prone to volatility in prices as compared to indices.

Investors can enter into various paired trades using this strategy. One of the more popular pairs used by hedge fund managers includes hedged pair trades in cnx it and cnx Bank Nifty index. cnx Bank Nifty is an index comprising of the most liquid and large capitalised Indian Banking stocks. The index comprises of 12 stocks from the banking sector which trades on the National Stock Exchange. It represent about 13.51 per cent of the free float market capitalisation of the stocks listed on nse and 89.79 per cent of the free float market capitalisation of the stocks forming part of the Banking sector universe as on 30 September 2013. This index is considered as a proxy to Indian banking stocks.

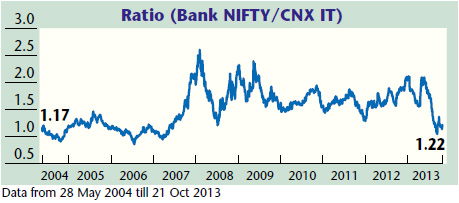

CNX IT index includes companies that have more than 50 per cent of their turnover from it and it related activities. This Index represents about 13.23 per cent of the free float market capitalisation of the stocks listed on nse and 97.94 per cent of the free float market capitalisation of the stocks forming part of the it sector as on 30 September 2013. This index is considered as a proxy to Indian it stocks. Without taking exposure to individual stocks from these sectors, investors can undertake paired hedged trade by betting on these indices. Now, let us understand how paired trades can be taken in these indices. Following is the long term chart of the ratio of cnx Bank Nifty to CNX IT.

In last nine years, the ratio has broadly ranged between 1 and 2.5. In very few instances the ratio has gone above 2.5 or below 1. In past four years between the second half of 2009 and now, the range has further narrowed down to around 2 and 1.

The ratio of 2.0 indicates that cnx Bank Nifty trades at twice the value of CNX IT index. Based on the historical reading of charts, this could be interpreted as cnx Bank Nifty has outperformed CNX it index in the near term. At this juncture the risk-reward ratio for the investor would be favourable if he goes long on CNX IT and shorts CNX Bank index. For a perfect hedge, the investor will have to buy two lots of cnx it and short one lot of cnx Bank Nifty as a perfectly hedged paired trade. In this trade, the investors can earn positive returns only if cnx it outperforms cnx Bank Nifty, absolutely or even relatively.

Similarly, the ratio of 1.0 indicates that cnx Bank Nifty trades at same value as cnx it. This could be interpreted as cnx it has outperformed cnx Bank Nifty in the near term. So, at this juncture, the risk reward ratio for the investor would be favourable if he goes long on cnx Bank Nifty and shorts cnx it. For a perfect hedge, the investor will have to buy one lot of cnx Bank Nifty and short one lot of cnx it as a perfectly hedged paired trade. In this trade, the investor would earn positive returns if cnx Bank Nifty outperforms CNX IT.

Currently, as on 18 October, this ratio stood at 1.21 which indicates that cnx it has outperformed Bank Nifty in a big way since May 2013, when the ratio was around 2.01. Looking at the historical trend, this seems to be good time for the investors to slowly start building paired positions by going long on Bank Nifty and shorting cnx it for next few months.

This article was originally published in Business India Magazine.

Write to us at news@valuelineadvisors.com

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.