With a strong government at the Centre, midcaps are set to outperform going ahead

Welcome NaMo… Our heartiest congratulations to Shri Narendra Modi for winning the General Elections 2014. Narendra Modi will be the first Prime Minister of India born after Independence.

The electorate of the country has given the strongest mandate in past three decades to the NDA-led by BJP, with Narendra Modi as its prime ministerial candidate. The BJP has won a clear majority on its own and is best positioned to push through reforms. Clearly, this is a mandate for development and good governance. The ruling party has been decimated to an extent that they fall short of qualifying themselves as leaders of the opposition. The strength of the mandate is an opportunity for the NaMo government to start the India story afresh, in the right direction.

Looking at the successful track record of Modi in Gujarat, there are very high expectations from the new government at the Centre from all the stakeholders. Modi has played an instrumental role in the economic development of Gujarat through various investor friendly policies.

Investors have realised the strength of the new mandate and are ready to take a fresh position on the India growth story. Stock markets are booming with fresh liquidity and beaten down mid-caps have already started outperforming. Though there is euphoria and while many FIIs poured money in before the results, amongst several local investors there is a left out feeling – those who were sitting on the sidelines waiting for election results. Investors are now betting for the better times ahead for the Indian economy.

Starting early-2014, the Indian markets were on a rise, primarily driven by anticipation of a strong and investor friendly government at the Centre with Modi as a PM candidate. Since the announcement of his candidacy on 13 September 2013, FIIs have invested over `1 lakh crore in Indian securities. Despite uncertainties over the outcome of the election results, FIIs have been aggressively buying Indian equities.

In past three months, between 3 February and 19 May 2014, the NIFTY has moved up from 6002 to 7264. Similarly, the CNX Mid-Cap Index has moved up from 7455 to 9908. This strong up move is primarily driven by FII flows, showing their confidence in Modi’s leadership.

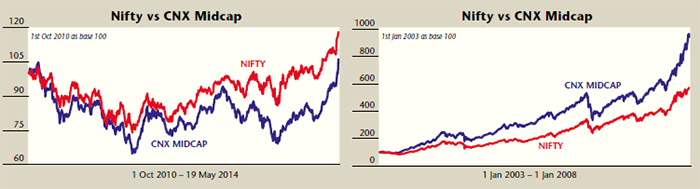

During the periods of low GDP growth and economic downturns, midcaps generally tend to underperform large caps because of the inherent risk of volatility in earnings and vulnerability to financial shocks. Since the beginning of the sharp market decline in January 2008, the CNX NIFTY has outperformed the CNX mid-cap. The NIFTY has given returns of 16 per cent as against 5 per cent returns by the CNX Mid-Cap Index. Similarly, between October 2010 and May 2014, when the Indian economy was crawling with lower GDP growth, high inflation and a lack of fresh investments, the CNX Mid-Cap Index underperformed the NIFTY by a huge margin. During this period the CNX NIFTY rose 18 per cent as against just a 6 per cent rise in the Mid-Cap Index.

Mid-caps tend to show outperformance during the periods of economic recovery and rising GDP growth. This was seen even during the 2003-2008 period when the CNX Mid-Cap Index outperformed the NIFTY by a huge margin. Between January 2003 and January 2008, the CNX Mid-Cap Index grew 9.4 times as compared to the NIFTY which grew 5.7 times.

Mid-cap stocks, which were hammered out of shape over the past 3-4 years, have made a strong comeback. However, in spite of their recent outperformance, mid-cap stocks are still available at reasonable valuations. With the anticipated improvement in economic activity and with a stable government at the Centre, mid-cap stocks are ready for a structural up-move in the years to come as was seen between 2003 and 2008.

This article was originally published in Business India Magazine.

Write to us at news@valuelineadvisors.com

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.