The volatility index can be a good tool to profit during market dips

The Volatility Index (VIX) is a measure of market’s expectation of volatility over the near term. Volatility is often described as the “rate and magnitude of changes in prices” and in finance often referred to as risk. Volatility Index is a measure, of the amount by which an underlying index is expected to fluctuate, in the near term, calculated as annualised volatility, denoted in percentage based on the order book of the underlying index options.

India VIX is based on the Nifty Index Option prices. From the best bid-ask price of Nifty Options contracts, volatility numbers are calculated. The India VIX is a measure of investor expectation of volatility in the Nifty.

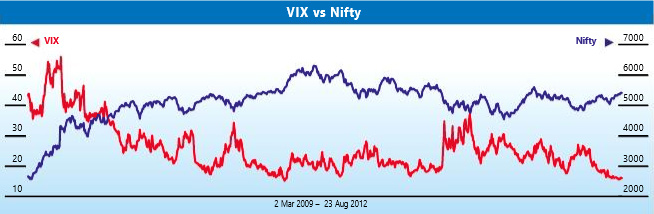

To understand how Nifty and VIX are correlated, we analysed the data points of India VIX and the corresponding Nifty values for the past three years. The analysis shows high inverse correlation between Nifty and VIX (see chart).

In the past three years since the India VIX was formed in March 2009, it has hit the all-time high of 56.07 on 19 May 2009 and all-time low of 15.22 on 6 September 2010 on closing basis. The chart shows, whenever VIX has reached the higher levels, markets have hit the intermediate lows. Similarly whenever VIX has fallen considerably to near all time low, markets have reached the intermediate top.

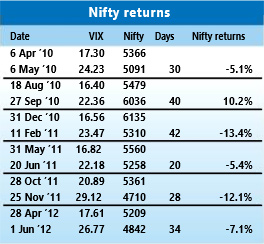

Let us take few examples when India VIX had reached the intermediate lows and how the Nifty has performed in the following month. One can clearly see that whenever VIX has fallen around 16-17 levels, except for one instance in August- September 2010, Nifty has always fallen over next 30-45 days. In August-September 2010 the Nifty had shot up by over 10 per cent even while VIX was trading at lows of 16.40 levels.

This article was originally published in Business India Magazine.

Write to us at news@valuelineadvisors.com

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.