As market valuations look stretched, can defensives start performing?

Indian markets have been on a roll since the new government came to power in mid-2014. Since then India’s macro factors have improved significantly, building a strong base for economic recovery. The NIFTY50 has now crossed 10550, rising over 30 per cent in the past one year. On the flip side, corporate earnings have failed to catch up with market momentum making equities look expensive on a historical earnings basis.

In the current market there is clear distinction between ‘Haves’ and ‘Have Nots’.

The companies from the ‘Haves’ list are market darlings and everyone wants to grab their share of the pie in anticipation of strong momentum. These companies are from sectors where there is a clear thrust from the government and are likely to benefit from the economic recovery. These sectors include industrials, engineering, metals and mining, energy, defense, iron and steel, cement, railways, auto & auto ancillaries, etc. These sectors offer good earnings visibility, and are aggressively sought after by the investor community. But the valuations of many of these companies look stretched on trailing earnings basis and hence growth in earnings is critical for sustenance of these valuations.

On the other hand, the companies in the ‘Have Nots’ list are the ones from the sectors where investors are not very optimistic due to lack of earnings visibility and uncertainty surrounding them. A few of these include traditionally defensive sectors such as technology/IT services, healthcare, pharmaceuticals, etc. These stocks were once considered investors’ darlings till 2014-15, but headwinds over last few years have taken off the sheen. These stocks have been beaten down despite having strong balance sheets, steady, free cash flows, and high payouts. These are now under-owned and offer good fundamental value to investors.

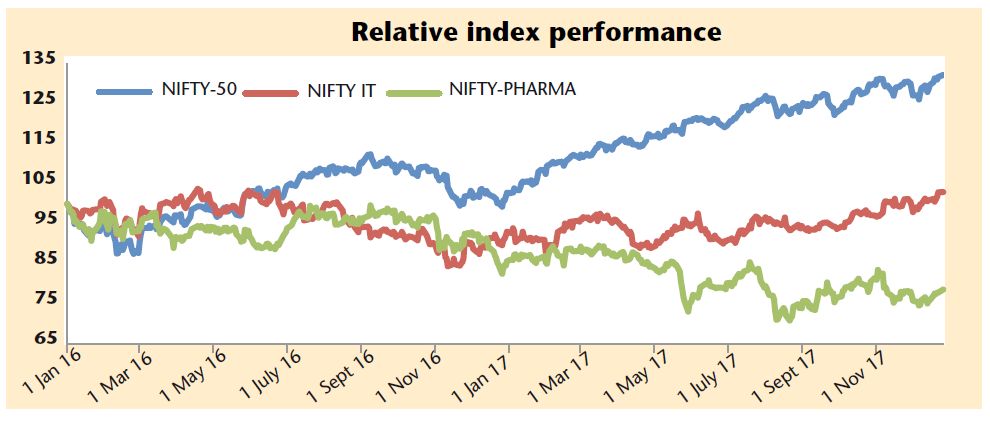

Since beginning of CY16, both the IT and pharma index have underperformed the NIFTY50 by a big margin. The NIFTY pharma index has fallen by over 20 per cent while the NIFTY IT index has remained flat – rising just 3 per cent. This compares to a strong 32 per cent rise in the NIFTY over the same period.

The pharmaceuticals and technology/IT services sectors have been suppressed in terms of earnings growth over past few years. These sectors have been facing multiple headwinds in the form of a strengthening Indian rupee against other global currencies and an uncertain macro environment in developed economies. The Indian rupee had appreciated 4.3 per cent in H1FY18.

The IT sector in particular faced major headwinds: slower demand from developed economies, US visa issues, etc. Indian IT companies which were earlier criticised for lack of innovation are moving towards innovation, and are looking at new geographies for growth. They have started establishing a firm presence in China to counter the slow demand from developed markets. The Q2FY18 results for the IT sector show that margins have remained resilient despite multiple headwinds, but this is partly due to a decreasing head count. To tackle the slowdown and curtail job loss, the government is likely to unveil a roadmap to achieve $1 trillion revenue in the high employment-generating Indian IT sector.

The pharma sector on the other hand has been facing multiple headwinds in the form of regulatory issues such as FDA compliances, pricing pressure in the US generics markets, pricing controls, etc. It seems many of these headwinds for both these sectors are partly getting resolved as the macro environment in the US and other developed economies is improving.

After the sharp appreciation of the Indian rupee in H1FY18, a significant part of the appreciation seems behind us and companies could eventually start seeing earnings recovery, albeit at a slower pace. While investors are rightly being cautious on both these sectors, does a strong balance sheet, healthy free cash flow and higher payouts merit a second look at these attractively valued sectors?

This article was originally published in Business India Magazine.

Write to us at news@valuelineadvisors.com

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.