NIFTY is unlikely to break 200-DMA decisively on the downside till elections

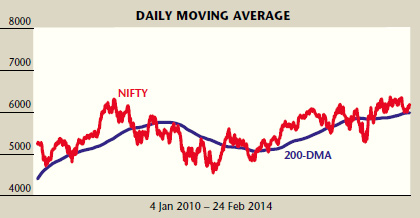

The 200-day-moving-average (200-DMA) is a long-term moving average that helps determine the overall health and trend of the markets. It is very widely tracked indicator by market participants. Investors pay special attention to 200-DMA as it acts as major longterm support or resistance for the markets. The decisive break of 200-DMA is considered to be an important indicator of change in trend for the markets.

For the past few quarters the Indian market has been on a roller coaster ride driven by various global and local factors. After making lows of 5285 at the end of August 2013, the NIFTY bounced back by over 1000 points at the beginning of November, when it touched 6300 levels. Since then NIFTY has been trading in the broader range of 5950 and 6350.

Market movement has been largely driven by various global factors such as tapering of the bond buying programme by the US Fed suggesting a revival in the US economy. The revival of the US economy is good for emerging markets like India as it would create multiple growth opportunities for export-oriented sectors. However, on the flip side, this tapering has led to a steep rise in 10-year US bond yields resulting in an exodus of foreign money from emerging markets. The move also created huge volatility in emerging market currencies. The slowdown in China has also turned global sentiment sour.

On the domestic front, the macro situation seems to be on the mend as reflected through improved fiscal position and a fall in inflationary pressure. However, an unexpected hike in interest rates by the RBI adversely affected sentiment. The RBI has clearly shown its resolve to fight retail inflation, suggesting a possibility of delay in reversal of the interest rate cycle.

With the general elections just round the corner, political parties are in election mode and are leaving no stone unturned to woo their vote bank. Political developments are closely followed by market participants. A strong performance by the Bhartiya Janata Party (BJP) in Rajasthan, Madhya Pradesh and Chhattisgarh in assembly elections indicates the popularity of the BJP in the upcoming Lok Sabha elections. Voterseat projection surveys done by various media houses, also point towards 200-plus seats for the BJP in the 2014 general elections. On the other hand a strong performance by the Aam Aadmi Party in Delhi during its maiden election contest has shown that voters have voted for an anti-corruption agenda and clean politics.

The recently announced resignation of the AAP government in Delhi for anti-corruption legislation has created a fresh wave of uncertainty in political circles. The Aam Aadmi Party has also announced its intention to contest the upcoming Lok Sabha elections.

The government has partially moved out of policy paralysis and has started taking measures for revival of the economy. As announced in the vote for account speech, the fiscal deficit for FY14 is expected to be at 4.6 per cent of GDP, as against the original target of 4.8 percent, and is expected to further fall to 4.1 percent in FY15 as against the original forecast of 4.2 per cent. The government has also taken steps to remove obstacles faced by infrastructure projects and has cleared various stalled projects. Even though these steps have significantly reduced the possibility of a sovereign downgrade, it is still long way towards a full-fledged recovery.

The market is currently consolidating in the 350-400 points range and is expected to remain in the same range till elections. On the down side, considering that the 200-DMA is placed at around 5985, we feel there is strong support around these levels. In the past couple of months the NIFTY has taken strong support around 6000 levels which is near 200-DMA. The market would decisively break all-time highs if the election results are as per market expectations. A fractured verdict in the elections could prove disastrous for the market.

This article was originally published in Business India Magazine.

Write to us at news@valuelineadvisors.com

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.