As macro-fundamental factors improve, bond yields will start softening

The Indian economy is slowly and steadily on the mend. The new government is working hard towards fiscal consolidation and has set aggressive targets for the next few years. The finance minister has accepted the 2014-15 fiscal deficit target of 4.1 per cent of the Interim Budget as a challenge and has kept the 2015-16 and 2016-17 target at 3.6 per cent and 3.0 per cent of GDP respectively. Though the current account deficit (CAD) is under control, the government is still watchful on that front. The wholesale inflation numbers have been showing a mixed trend over past few months and are trending downwards; though there is a risk to this trend due to weak monsoons and ongoing turmoil in Iraq.

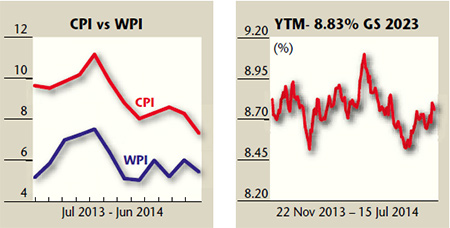

The WPI has fallen to 5.43 per cent and the CPI inflation to a 29-month low of 7.31 per cent with the fall in food prices, suggesting a relieving of the inflationary trends in the economy. The recently announced IIP data also shows encouraging signs with a rebound in the manufacturing and mining sector.

The bond yields are linked to various factors such as the fiscal position, liquidity conditions, inflationary environment, currency movement, trade and current account deficit, fresh supply of government papers, sovereign rating, etc.

Rating agencies have maintained the status quo on India’s sovereign rating post the Union budget announcement, providing relief to the government from the risk of a sovereign downgrade. Credit rating agencies feel that the Union budget 2015 was a step in the right direction, even though it lacked details. The Union budget is expected to help revive growth prospects for the ailing infrastructure sector.

The government’s 8.83 per cent bonds maturing in November 2023 are offering yields of 8.75 per cent now and are trading within a broad range of 8.55-8.85 per cent in recent times. Even the AAA-rated tax-free bonds by government companies such as NHAI, REC, PFC and IRFC are offering yields of about 7.8-8 per cent in the secondary markets. The yields on these tax-free bonds have fallen post budget, as demand for these bonds have shot up due to the lack of a fresh supply of the tax free bonds. The recent revision of the tax-rate for non-equity funds has resulted in a huge outflow from debt funds, leading to a strengthening of bond yields.

Even banks are currently offering interest rates at 8.75-9 per cent on fixed deposits with 1-5 year tenures. In the previous monetary policy, the RBI had taken steps to improve liquidity in the system by reducing SLR by 50 bps – from 23 per cent to 22.5 per cent. With a gradual improvement in the liquidity situation, banks would eventually start reducing interest rates on long-tenure FDs. SBI has recently announced a reduction in interest rates by 25-50 bps on FDs up to 179 days.

RBI has set its CPI inflation target at 8 per cent for January 2015 and 6 per cent for January 2016. If the inflation rate trajectory is better than the RBI’s targets, the central bank may start lowering interest rates to boost growth. Though, at present, this looks unlikely, given the possibility of a draught-like situation in the country and high volatility in crude prices due to the Iraq crisis, potentially affecting deficit situation adversely. The government is even working on reducing subsidies by deregulating fuel prices, which may add to the inflationary pressure in the near term.

The interest rates may remain at such elevated levels in the short-term till there is an improvement in the fiscal position and clear visibility of inflationary trends. These rates are nearing the peak and investors must take this opportunity to lock in to higher bond yields for a longer investment duration to benefit from any fall in the interest rates over the medium-to long term. Given the inverse relationship between bond yields and bond prices, any softening of bond yields would result in price appreciation for bond holders.

Investors must not forget the importance of maintaining proper asset allocation at all times. Investment in long-term bonds for a longer investment horizon would help investors build a safer and stronger fixed income portfolio. Once interest rates start falling, it would be difficult for investors to get such high yields on fixed income products.

This article was originally published in Business India Magazine.

Write to us at news@valuelineadvisors.com

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.