Rupee is not showing strength despite strong FII inflows

Looking at various macro indicators, there are clear signs that the Indian economy has bottomed out. The sentiments in the investment community have improved significantly and there is a sense of optimism all around. Investors expect the economic recovery to gather pace over the next few quarters. Based on this optimism, Indian equities are touching new highs, with CNX-NIFTY crossing the 8150 mark. Foreign investors are aggressively investing billions of dollars into the Indian markets, not just into equities, but also in the debt markets. However, despite this, the Indian currency is not showing strength. Is there any invisible hand at work?

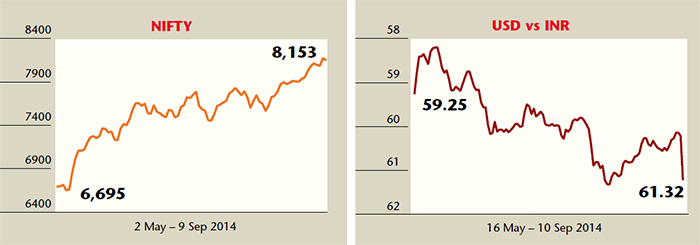

Since the beginning of May 2014, CNX NIFTY has moved up by 22 per cent from 6695 to 8153. FIIs have invested over $22.6 billion in Indian markets ($8.7 billion in the equities and $13.9 billion in debt market). Despite such strong FII inflows, $/Rs has depreciated by 2.6 per cent from 59.25 on 16 May 2014 to 60.84 on 10 September 2014, after touching lows of 61.32 on 9 August 2014. Also, during the same period, India’s foreign exchange reserves have soared from $315 billion to $319 billion.

Market participants believe there is invisible hand of the Reserve Bank of India (RBI) in action, which is preventing the rise of rupee. RBI is believed to be intervening into the currency markets to keep Indian currency under check. The flood of foreign liquidity into the country has increased problems for the central bank, who wants to see rupee trade near its fundamental value, so that Indian exports remain competitive to support economic recovery, without losing any momentum caused due to speculative volatility.

While the investor sentiments reflect optimism, it is ahead of time. The real improvement in economy is still slow. IIP data is showing weakness, PMI has fallen marginally (through it is in expansion mode), inflation and interest rates are high; current account deficits and trade deficits have widened. The economy is still not completely out of woods. The real effective exchange rate (REER) for $/Rs is 60.43, which is in line with the $/` rates prevailing in the markets.

In last one year, since August 2013, India’s foreign exchange reserves have grown by a huge $40 billion to $319 billion. RBI is seen building its war chest by buying dollars whenever the Indian currency is seen strengthening beyond its real fundamental value. This is to prepare itself for any unforeseen global shocks and the rise in US interest rates. The rise in the US interest rates could potentially cause FII outflows from the emerging markets such as India creating volatility in the Indian currency and risking economic recovery.

The recent announcements by the ECB to further cut benchmark rates and launch monetary Quantitative Easing Programme is expected to improve global liquidity. The withdrawal of Fed’s QEP is unlikely to significantly affect inflows in to emerging economies such as India as global liquidity is expected to remain robust amid ECB’s fresh stimulus starting October, the quantum of which is still unknown. As the economy improves over next few quarters, India could attract significant portion of the excess global liquidity from the foreign investors.

This article was originally published in Business India Magazine.

Write to us at news@valuelineadvisors.com

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.