Indian equities to see repeat of 2008-2009 period.

Indian equities are on a roller coaster ride. The fall in the markets over past few months has been so ferocious that it has shaken the confidence of investors. Mid-cap and small cap stocks, which were yet to recover from the previous fall, have further corrected, spilling blood on the street. Even the best of the blue-chip companies have seen massive erosion in their market caps.

The correction over the past few months has been more severe than anybody’s expectations. The excesses in terms of valuations have now corrected significantly. The correction was primarily on account of multiple headwinds faced by the Indian economy through a combination of global and domestic factors. Barring a few, most of these factors are temporary, rather than structural.

The USD-INR fell to an all-time low of 74.34 on 9 Oct, falling 16 per cent in CY18. The US Fed has been raising interest rates resulting in higher yields on US bonds. This has led to an increased outflow of liquidity from emerging markets, adding to the pressure on the Indian Rupee.

International crude prices are on the rise – a result of global factors such as US sanctions on Iran, tensions in the Middle East, curtailment of supply by OPEC, etc. Brent crude has shot up to a 52-week high of $86.74on 3 Oct 2018 – up 27 per cent in CY18. Crude is unlikely to remain at elevated levels for long as higher prices have led to increase in supply amid sluggish demand.

In the run up to US mid-term elections, the Trump government has been adopting protectionist measures by announcing tariffs on Chinese goods. China retaliated to these measures by levying counter tariffs. This has resulted in trade-wars, causing turbulence in global trade. The situation is likely to improve once the mid-term elections are over in November.

The threat of US sanctions on India post India’s decision to buy Iranian Crude and signing of the defence deal with Russia has further soured investor sentiment.

Domestic bond yields have been hardening in the recent times touching highs of 8.23 per cent. Retail fuel prices are near all-time highs due to rising crude and weakening currency, adding to inflationary pressure. In an unexpected move, the government reduced excise duties by Rs1.50 per litre and also reduced margins of the oil marketing companies by Rs1 per litre. Interference by the government in pricing of fuel aggravated the fall as investors feared backtracking on the policy of deregulated fuel prices by the government.

Uncertainty over the revival of IL&FS has increased systemic risks, resulting in rise in domestic bond yields. There is a fear of contagion spreading across other asset classes if the IL&FS issue is not adequately resolved.

Despite these domestic headwinds, inflation is still within control. In the last policy meeting, the RBI rightly decided to keep interest rates unchanged shifting its stance to calibrated tightening as against consensus view of raising interest rate by 25 bps. After the RBI policy announcement, yields have now softened to 7.95 per cent.

The Indian economy is much better placed now as against in 2014 when macro headwinds were more severe and structural amid policy paralysis. The recovery of earnings momentum is on track as is visible from the initial trends of the results season. The government has taken steps to increase agriculture income by increasing the minimum support price for farm produce. This will boost rural demand.

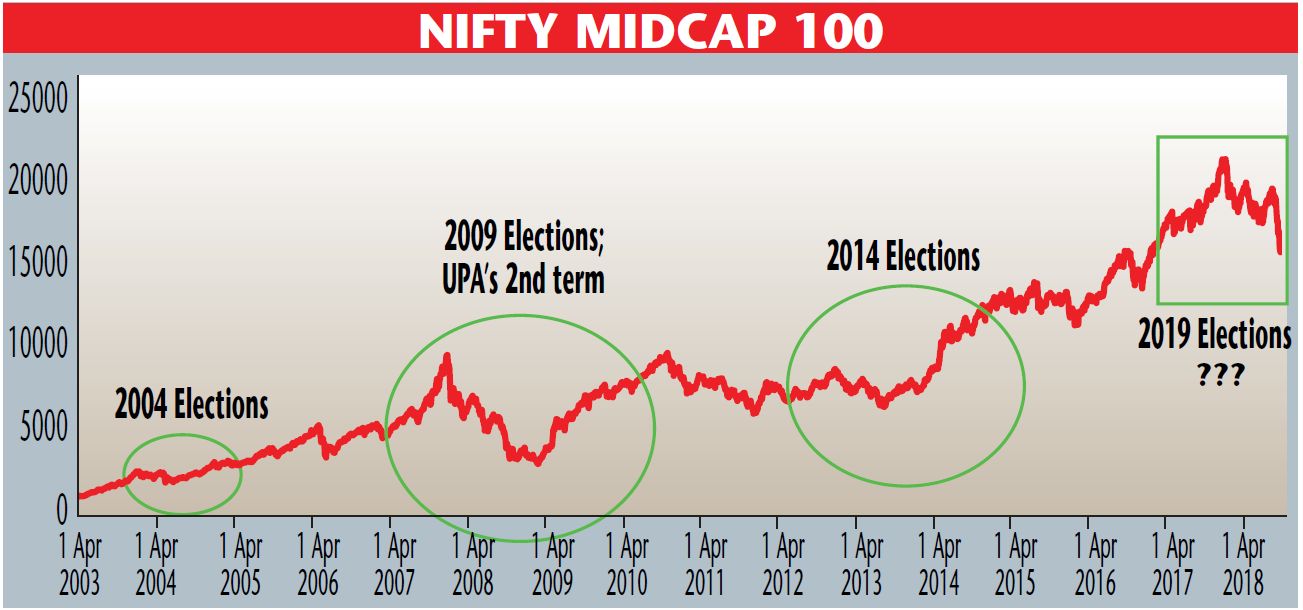

The election season in India has just started with announcement of election dates for five states. The state elections are to be held in phases starting from 12 November and results are to be announced on 11 December. The more important Lok-Sabha elections are scheduled to be held in April-May 2019. Historically, markets tend to remain indecisive and volatile in the run up to elections, but recover sharply post the event. These are the best times for the investors to build strong portfolios and generate alpha from their investments over the medium to long term.

In the near term, corporate earnings and outcome of state elections will dictate market trends. Markets are likely to resume an uptrend post the mid-term elections in the US. The rally should gain momentum post the outcome of the Lok Sabha elections. Déjà vu – Indian equities to see a repeat of the 2008-2009 period.

This article was originally published in Business India Magazine.

Write to us at news@valuelineadvisors.com

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.