A weak dollar, coupled with strong domestic flows to support Emerging Market equities

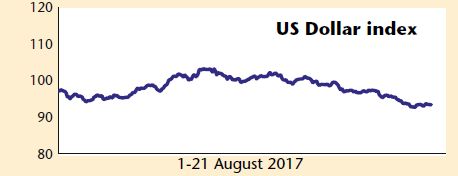

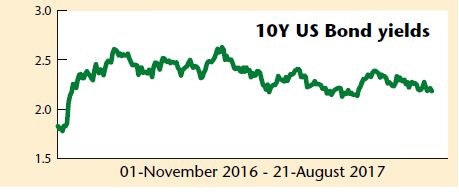

We had last written about the Dollar Index in the Business India issue dated 16-29 January 2017, when the Dollar Index was quoting at elevated levels of 103 – sharply up from the 97 levels since Trump’s victory as the US President in November 2016. The US markets (Dow Jones Industrial Average) had shot up to 20000 from 18000 levels, and the US 10 year bond yields rose to a high of 2.64 per cent, in anticipation of big bang reforms by the newly elected president. The rally in the US markets was driven by a huge outflow of liquidity from the emerging markets to the US markets, resulting in a sharp correction in the Indian debt as well as equity markets.

The rally in the Dollar Index and the US bond yields at elevated levels seemed unsustainable, as major positive news after Trump’s victory was already factored in. In just eight months since January 2017, the Dollar Index has now corrected to 93.50 levels. The 10 year US Treasury bond yields have also corrected from the elevated levels of December 2016-January 2017 period to 2.18 per cent now, despite two interest rate hikes totaling 50 bps in March and June 2017. The reversal of the Dollar Index from its highs has resulted in a rush of liquidity from developed markets back to the emerging markets like India. NIFTY has gained steadily from the 8100 levels in January 2017 to over 9800 now, after touching 10000 levels by the end of July.

The Dollar Index is now at more realistic levels, with the dollar losing its sheen, as there is a big let-down on the expectations from the Trump administration. Trump has recently announced the disbanding of two White House advisory groups, which will make it tougher for him to fulfill any pro-growth, pro-business agenda, which will weigh heavy on the US economy. The outlook for the US economy has suddenly started looking uncertain and the sentiments have turned sour.

The minutes from the FED meeting suggests that inflation in the US will continue to remain below 2 per cent for an elongated period, thereby weakening the case for further rate hikes in the near term. This is sentimentally positive for the Indian equities. The flow of liquidity will keep chasing emerging markets, as long as the dollar continues to remain week.

On the other hand, the Indian economy is on a firm footing, as the government continues to remain focused on building a strong base for the next leg of growth. A lower inflation has helped in reducing interest rates in the economy. Lower deposit rates, coupled with stable political environment and up-looking Indian economy, has helped in channelizing domestic financial savings back from physical assets to Indian equities. The launch of a new indirect tax regime, GST, has been smoother than anticipated. The domestic savings is steadily getting channelized into Indian equities.

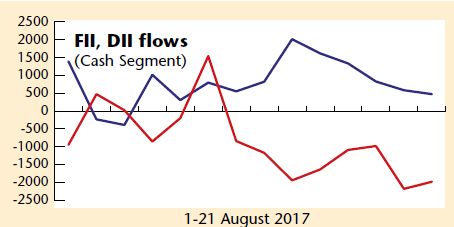

FIIs have been selling aggressively due to the ongoing geopolitical tension between North Korea and the US, as also the uncertainty prevailing over the ongoing military stand-off between India and the China at Doklam. During 1-21 August 2017, FIIs have sold Rs11,700 crore worth of equities in the cash segment, while DIIs have purchased over Rs11,100 crore in equities. This shows that the tsunami of domestic liquidity is helping in cushioning the selling pressure in the markets.

Sharp corrections in the markets, if any, should be seen as an opportunity to add exposure to Indian equities, as fundamentals of Indian equities continue to remain attractive from a longer-term perspective.

This article was originally published in Business India Magazine.

Write to us at news@valuelineadvisors.com

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.