Fall in nominal interest rates to drive flows to equities

Historically, Indian households prefer investing their savings into bank fixed deposits and small saving schemes due to averseness to taking market-linked risks and regular interest income. A substantial part of their savings also goes into accumulation of non-interest-yielding real assets such as gold, silver, etc. They perceive this as creation of family wealth. The retail participation into Indian equities has always remained abysmally low with only 2 per cent of Indians investing in equities.

Over the past few years, Indians have enjoyed high interest rates on their bank deposits and small saving schemes as interest rates have remained high due to persistently high inflation rate. Since the new government has taken control of the economy in May 2014, through prudent fiscal management and sharp cut in wasteful expenditure and subsidies, India’s high deficit situation and inflation has come under control. A sharp fall in global commodity prices, including crude, precious metals and other industrial commodities have further helped in controlling inflation.

A steady fall in inflationary trends and credible fiscal management by the new government has encouraged the Reserve Bank of India (RBI) to cut interest rates. It has cut the policy repo rate by 125 bps since January 2015; this includes a sharp 50 bps repo rate cut on 29 September. The fall in repo rate has resulted in a corresponding fall in interest rates on bank deposits. The returns from precious metals and other commodities have remained lackluster too.

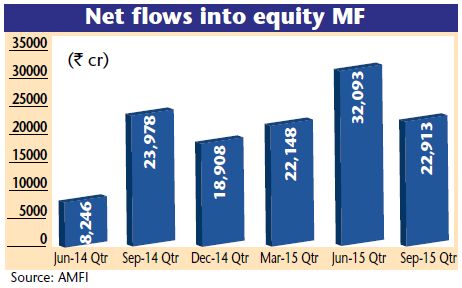

The fall in nominal interest rates acts as a dampener for the retail investor, who is now used to high interest rates on their savings. The steady fall in interest rates on bank deposits and other small saving schemes and lackluster returns from other asset classes is driving retail investors to invest part of their incremental savings into equities. Domestic mutual funds have witnessed net inflows of Rs77,200 crore into equity funds since the beginning of 2015. As per a recent article in Mint, DII holdings in 320 BSE-500 shares at the end of the September 2015 quarter hit their highest level in at least 25 quarters.

All the macro factors such as stable political climate, improving investment climate, investor-friendly government, economic recovery, stable inflation, and prudent fiscal management are making investments into equities conducive for investors. Monthly inflation and IIP data showing notable improvements confirms the belief that recovery is underway in the Indian economy. The government is taking measures to remove roadblocks to revive growth, despite challenges of maintaining balance between fiscal prudence and increasing public spend on infrastructure.

While nominal interest rates are falling, real interest rates have steadily gone up. Over the past one year the inflation rate has fallen at a much quicker pace as compared to the fall in interest rates resulting in a rise in real interest rates. Real interest rate is calculated as nominal interest rate minus inflation rate. For the past three years, real interest rates in India have practically remained in the negative as inflation remained stubbornly high, nullifying the benefits of high nominal interest rates.

To benefit from the fall in interest rates, FIIs have invested over $30 billion in Indian debt markets between 1 April 2014 and 20 October 2015. Bond prices and interest rates are inversely related. So, any fall in the interest rate results in a rise in bond prices.

The RBI has stated that given the current state of the economy, real interest rates should remain at 1.5-2 per cent. With real interest rates being much higher currently, there is further scope for reduction in policy repo rates by at least 50-100 bps in the times to come. The fall in nominal interest rates will reduce cost of funds for the corporate sector-driving profitability. It will also help boost the investment cycle, driving overall economic recovery.

Lower nominal interest rates will act as a deterrent for retail investors and would encourage further flow of incremental savings into equities. Supportive macro factors make India one of the most sought after emerging markets globally. The trend of buoyant inflows into Indian equities is expected to continue in the years to come, which will drive Indian equities to new highs

This article was originally published in Business India Magazine.

Write to us at news@valuelineadvisors.com