Time for sector rotation.

The Long-Short hedging Strategy is a tool to hedge trades positionally. This strategy is extremely useful to minimize risks by going long in one script / index and take short position in other script / index to hedge the position.

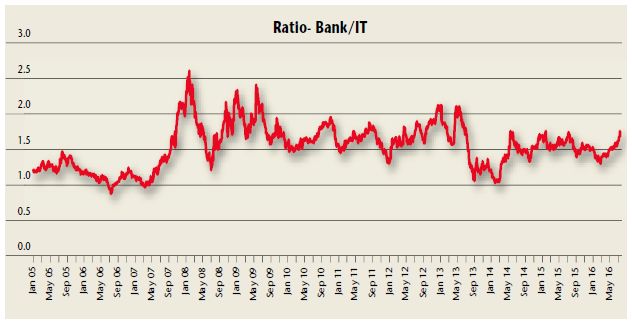

It could be seen in the attached chart how the ratio of Bank Nifty to IT Index traditionally remains in the range of 1.0 and 2.0 most of the time. As the ratio moves towards the extremes, it throws up some excellent investment opportunities with favorable risk-rewards, enabling investors to earn positive returns positionally over medium term. The ratio of 2.0 means Bank NIFTY trades at twice the IT index, suggesting the opportunity to go long on IT index and short Bank Index positionally. Similarly, the ratio of 1.0 suggests the investment opportunity other way round – i.e. going long on Bank index and shorting IT index.

In last 3 years the range of this ratio has further narrowed to about 1.75 on the upside. The Ratio of Bank NIFTY to IT NIFTY is currently at 1.75, and is quoting at the higher end of the 3 year range after hitting 12-month lows of 1.30 on 25th Feb 2016.

Bank NIFTY has moved from 13556 on 25th Feb to 18824 on 15th July (intraday market price), giving returns of 39%. On the other hand IT index has largely underperformed and has gone up by just 3%, from 10404 to 10762 (15th July, intraday market price). IT index has substantially lagged NIFTY returns.

NIFTY 50 during this period has gone up by 25% from lows of 6826 to 8565. The sharp rally in NIFTY 50 in last 4-5 months was driven by all round positive developments in the economy such as announcement of realistic union budget, prudent fiscal management, timely onset of monsoons, approval of VII Pay Commission, favorable results for the BJP government in state elections, possibility of passage of GST bill in Rajya-Sabha during forthcoming monsoon session of parliament, turn around in corporate earnings, RBI’s measures to clean-up bank balance sheets, focus on infrastructure spending, etc. During this period, markets have ignored risks from global developments such as slowdown in China, BREXIT fallout, possibility of rate hike by US Fed, etc.

This suggests markets may have already priced in most positive news. However, given possibility of interest rate cut by RBI in 9th August monetary policy meeting after benign retail inflation in June, there could be last leg of rally in Bank NIFTY. Retail CPI inflation stood at 5.77 per cent in June as against 5.76 per cent last month and 5.40 per cent in June last year. India has seen good monsoons this year, which will further douse food inflation.

The results of leading IT companies and their forward guidance have disappointed the street, leading to sharp correction in stock prices. This could further affect IT index performance in the near term. All these factors may take the ratio of Bank NIFTY to IT index closer to 2.0, providing perfect hedge trade investment opportunity for investors.

After sharp rally of past few months, markets may consolidate in 200-300 point range on NIFTY 50. Sectors such as Financials, Metals, Realty & Infra, which have outperformed NIFTY 50 by big margin since 29th Feb may take some breather and the underperforming sectors such as IT, Pharmaceuticals, FMCG, Oil and Gas etc. may start performing. Indian government has taken strong policy decisions in Oil and Gas sector. After decontrolling diesel prices in late 2014, it has decided to increase kerosene prices by 25 paisa per month till April 2017. This will help OMCs to reduce losses on sale of subsidized kerosene. India has taken steps to attract investment in Indian Oil & Gas sector.

With huge underperformance of IT stocks over past one year, the valuations have become quite attractive relative to NIFTY. This could trigger value buying opportunities in IT stocks in the times to come.

This short phase of consolidation in NIFTY 50 post sharp rally of past few months will strengthen the technical strength of NIFTY. Every correction in the market is an opportunity for investors to buy during long term bull phase.

This article was originally published on www.moneycontrol.com. (http://www.moneycontrol.com/news/expert-columns/niftyconsolidation-phase-time-for-sector-rotation_7054901.html)

Write to us at news@valuelineadvisors.com

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.