Consolidation seen in frontline stocks; mid- and small-caps to outperform.

The NIFTY50 has staged a strong comeback from 10589 (28 June18), to regain all-time highs of 11760 (28 August 18) – a gain of over 10 per cent in just two months. Top stocks which contributed to NIFTY’s rise were heavyweights like Reliance Industries (+40 per cent), Axis Bank (+31 per cent), Bajaj Finance (+29 per cent), ICICI Bank (+25 per cent), ITC (+20 per cent), Bajaj Finserve (+19 per cent), UltraTech Cement (+19 per cent), SBI (+19 per cent), Wipro (+15 per cent) and HCL Tech (+14 per cent). This rally has come in spite of concerns on valuation front by the analyst community. The rally in frontline stocks seems to have matured and NIFTY50 is likely to consolidate in the range for next few months – till the US elections are over in November 2018.

The Trump administration has adopted protective trade policies by levying tariffs on Chinese imports, which has been strongly retaliated by the Chinese government through similar tariffs on US exports to China. This has escalated into a trade war between two large economies, thereby creating a ripple effect on trades across countries. Asset prices and currencies globally have faced turbulence.

This ongoing turmoil is likely to subside once the US elections are over in November 2018. Sentiment towards Indian equities too has soured as the rupee continues to weaken amid rising crude prices. USD/INR has touched all-time lows of 71.01, down 3.9 per cent since 1 August and down 11.3 per cent since the beginning of CY18. Foreign portfolio investors have a bullish view on the Indian economy, but are hesitant to invest due to the falling currency. They have invested a net sum of Rs1,775 crore into equities and Rs3,414 crore into the debt market in August 2018. The financial crisis in Argentina and Turkey too affected investor sentiment. The Argentinean Peso and Turkish Lira are down 52 per cent and 42 per cent respectively. The current phase of weakening of the Indian Rupee is temporary and is expected to correct once the ongoing global turmoil subside.

Crude continues to trade at elevated levels due to falling inventories and lower production. This is on account of geopolitical factors such as Iran sanctions, Venezuela crisis, etc. As India imports over 70 per cent of its demand, higher oil prices and the falling rupee has resulted in a rising import bill thereby worsening fiscal deficit and rising interest rates. The Brent is currently trading around $78. This trend of rising crude is expected to correct in the long run.

The results announced for the June 2018 quarter suggest a turn around in corporate earnings. There were more hits than misses. India’s GDP grew at 8.2 per cent in the April-June 2018 quarter on the back of strong performance by manufacturing and construction sectors –significantly above the consensus estimate of 7.7 per cent. This is the fastest growth rate in the past eight quarters. With the resolution of NPA issues and strong momentum in economic activities, the new investment cycle looks ready to gather steam. This should set stage for a secular bull-run for the Indian markets in the years to come.

The flow of domestic savings into equities through mutual fund route is gaining strength. The monthly SIP amount flowing into mutual funds has crossed Rs7,500 crore per month and is likely to cross the Rs10,000 crore mark in FY20 as per AMFI CEO, N.S. Venkatesh. This flow of retail savings into equities should make Indian markets more resilient to global shocks.

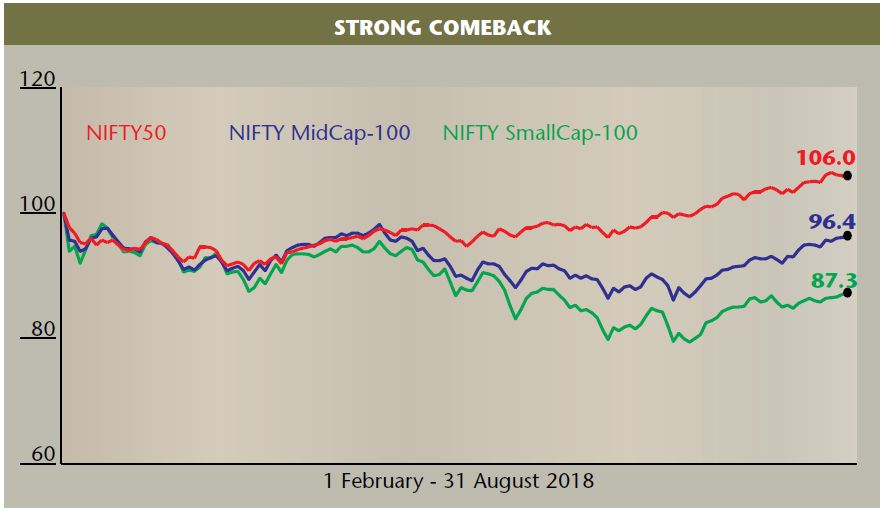

The NIFTY50 has regained its all-time highs but mid-cap and small-cap indices are still waiting for the momentum to turn in their favour. The NIFTY50 is up 6 per cent from 1 February (Union budget announcement), but the NSE MidCap-100 and NSE SmallCap-100 Index are still down 3.6 per cent & 12.7 per cent respectively. There is comfort on valuations in many high-quality mid and small-cap stocks. As frontline stocks take a breather, mid-caps and small-caps should start making a strong comeback and participate in the rally sooner than later.

This article was originally published in Business India Magazine.

Write to us at news@valuelineadvisors.com

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.