Markets all set for the festive season

The Indian economy is currently going through its own set of challenges. The systemic clean-up undertaken by the government is affecting business momentum and thereby slowing economic activities. The health of any economy depends on the strength of its financial sector. Over the past few years the Indian financial sector has been on a weak footing. The skeletons of NPAs still keep tumbling out of the financial system. The fraud in PMC Bank raises questions on the quality of checks and balances put in place by the regulators. These developments have shaken the confidence of depositors.

Business momentum too has taken a hit. The IIP for August 2019 has contracted by 1.1 per cent as compared to 4.6 per cent growth in the previous month. Multiple agencies have downgraded India’s GDP forecast for FY20 – the latest one coming from the World Bank and IMF, which have reduced India’s growth forecast to 6 per cent and 6.1 per cent respectively. The global environment continues to remain uncertain.

Indian equities have continued to struggle in spite of some big-bang announcements by the government. Foreign portfolio investors have been hugely negative on Indian equities and have sold over Rs6,200 crore worth of equities since the beginning of October 2019. Since last couple of days FIIs have turned buyers in Indian equities.

Are there more downgrades waiting to happen or is there any ray of hope visible for Indian markets? In all probabilities, this languishing trend could possibly be nearing an end. Indian markets may have already factored in most of these negatives.

Amid talks of slowdown in consumer demand, there are reports of strong growth in sales by e-commerce giants – Amazon and Flipkart during their recent festive sales. As per estimates these e-commerce giants are expected to clock sales of about Rs39,000 crore in October. Hindustan Unilever and Parle have announced strong results, refuting the talks of a sharp slowdown in consumer demand.

The Indian government has made big ticket announcements to revive growth. The foremost being a mammoth Rs1.45 lakh crore push by cutting corporate taxes. This is a master stroke by the government and is expected to add about 15-25 per cent to corporate profitability. Investors are currently ignoring the cascading positive impact of this tax cut on GDP. This move has the potential to add Rs25-30 lakh crore to the valuation of Indian markets. Recently, in one of the election rallies in Maharashtra, PM Narendra Modi spoke about the government’s intent to spend Rs25 lakh crore for development of rural infrastructure.

The RBI has recently cut repo rate to 5.15 per cent and has further maintained a dovish stance, as inflation continues to remain within its comfort zone. Lower interest rates should boost capital formation in the economy. The interest rate cut has led to lower bank term-deposit rates thereby affecting interest income for savers. Savings, which were getting channelised into banks, will eventually start getting into equities in search of extra returns.

There are signs of de-escalation of US -China trade war. The US Federal Reserve continues to maintain a dovish stance indicating further reduction of interest rates in the future. The Fed Reserve also announced that it would begin buying about $60 billion per month in treasury bills at least through the second quarter of 2020. This could lead to flood of liquidity into emerging markets. FIIs are currently heavily short on equities. The short covering by FIIs will result in flood of liquidity entering Indian markets. Global markets have already started rallying and it is just a matter of time before Indian equities will join the party.

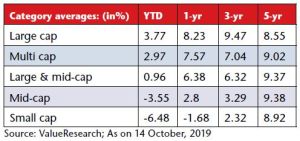

Equity as an asset class has failed to generate good returns for investors over the last 2-3 years. The performance of mid-cap and small-cap stocks has been even worse as they have failed to generate even inflation-beating returns over a three-year period.

The returns in equities are usually non-linear and tend to over-stretch on either side. But eventually over a long term they tend to reverse to the mean. Over a 15-year period the Nifty 50, MidCap100 and SmallCap100 have given 13.1 per cent, 13.5 per cent and 11.6 per cent returns respectively. This means reversion of Indian equities will eventually play out in the times to come. Investors will be better-off allocating a higher share of their savings to equities.

This article is to be originally published in Business India Magazine.

Write to us at news@valuelineadvisors.com

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.