Indian equities are expected to play catch-up with the emerging market rally.

For the last few months, Indian equities have been in consolidation mode, even as global equities were tumbling down. The global equities had seen a precipitous fall in December, primarily driven by concerns over a global economic slowdown, tightening by the US FED, uncertainty over Brexit, ongoing trade wars, and other geo-political factors. They have now lost over $20 trillion in value since January 2018. With all these negative developments, it seems global equities have made a strong technical bottom in December 2018. In the last one month, most emerging markets have showcased a strong comeback with sharp rallies of 5-10 per cent.

The overall global scenario has been changing fast and dramatically, which has helped change liquidity flows. As against the consensus estimates of an interest rate hike by the US Federal Reserve in 2019, the focus is now clearly changing towards the possibility of a reduction in interest rates to push growth momentum. If the interest rates in the US start reversing, strong liquidity will flow from the US to emerging markets. The rising dollar index made an interim top at about 97.70 in mid-December and is likely to reverse its trend going forward. These developments should lead to a continuation of the liquidity-driven rally in emerging market equities. China too has recently cut its bank reserve ratio by 100 bps in the push to drive economic growth.

India has not participated in the ongoing rally in the global emerging markets. India VIX is now quoting at 16-17 levels. The fall of India VIX below 16 levels will further strengthen the rally for the Indian equities. A low VIX is an indicator of lower volatility.

Macro factors, which have been against India till now, have started turning favorable. Brent crude has corrected significantly to about $58, after touching a 52-week high of over $86 in early October 2018. Rise in oil prices had led to higher fuel prices and worsening deficits. Despite a sharp rise in crude prices, India has managed to keep inflation under control.

Looking at inflation and growth dynamics, the RBI may consider cutting interest rates going forward, which will help boost capital formation in the economy. The GDP estimates for 2018-19 have come in at 7.2 per cent, as against an expected 7.4 per cent but they are still higher than the 6.7 per cent achieved last year.

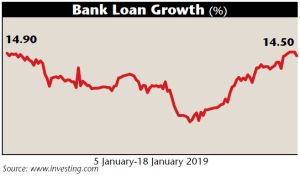

There are clear trends suggesting an uptick in the economic activity. Bank credit has grown by 15.1 per cent y-o-y in December 2018 and 14.5 per cent y-o-y as per data released on 18 January 2019 and is now back to five-year highs. This is a clear sign of revival in consumption demand, rising capacity utilisation and higher capex. However, the ongoing uncertainty over the IL&FS saga and refusal of the RBI to cut interest rates despite low inflation, has kept liquidity tight in the system. This has hampered economic revival, as is reflected in an anaemic IIP growth. India currently has one of the highest real rates among most large economies.

The CSO has projected a huge 12.2 per cent jump in gross fixed capital formation (GFCF) in 2018-19, as against 7.6 per cent last year. The reported successive three quarters of double digit growth has led the CSO to suggest GFCF-to-GDP ratio of 29.5 per cent in 2018-19 – up one full percentage point over the levels for the past two years (28.5 per cent).

Despite the turbulence in equity markets, domestic retail savings are steadily getting channelised into equities through the mutual fund route. The MF industry has recorded an inflow of Rs8,022 crore through the SIP route in December 2018 – a rise of 0.46 per cent on a month-on-month basis.

However, in the near term, there is huge uncertainty pertaining to the impending Lok-Sabha elections scheduled to be held in the summers of 2019, which is keeping Indian equities indecisive. Investors are hoping for a stable government so that they can see a continuity of reforms. The initial set of results declared by corporate India indicates a steady earnings recovery.

Indian markets have underperformed in the last one month vis-à-vis other emerging markets. Strong corporate results, coupled with favourable global flows, will eventually result in a catch-up play by Indian equities – sooner than later.

This article was originally published in Business India Magazine.

Write to us at news@valuelineadvisors.com

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.