Strong fundamentals to take control over technical weaknesses.

Indian markets are undergoing an interesting phase, where the country’s macro-economic fundamentals are steadily on the mend, but investors are confused about the road to recovery, due to uncertain global factors and uncertainty over earnings growth. Over the past few years, India has seen consistent downgrades in consensus earnings estimates causing turbulence in equity markets.

After five consecutive quarters of declining-to-flattish earnings growth, leading companies are now expected to see some improvement. The ongoing earnings season is off to a decent start, with both Infosys and TCS beating street estimates.

India’s fundamentals have strengthened since the new government took control. Despite two consecutive years of weak monsoons, inflation has remained under control. CPI inflation has eased to 4.83 per cent in March 2016, while WPI inflation remained at minus 0.85 per cent, remaining in negative territory for the 17th month in a row.

The ministry of finance has claimed that the government has successfully met its fiscal deficit target of 3.9 per cent for FY16. The government has further decided to stick to its earlier set fiscal deficit target of 3.5 per cent of GDP in FY17.

According to the RBI, implementation of the VIIth Pay Commission and OROP can put upward pressure of 1-1.5 per cent on inflation but, at the same time, it will add 40 bps to GDP in 2016-17. Despite this, the RBI has maintained its retail inflation target of 5.0 per cent in March 2017.

Moody’s too has marked the government’s ‘Make in India’ initiative a huge success, with net FDI inflows hitting all-time highs in the beginning of 2016. The rise in FDI points to stronger investor interest in India. India’s ‘Make in India’ initiative is seen to be stimulating oil consumption. IEA sees India as fastest growing crude consumer through 2040.

IIP for February 2016 grew by 2.0 per cent, driven by strong performance in mining and electricity sectors. This positive growth has come after three consecutive months of contraction. The core sector of the economy such as cement has witnessed strong uptick in volume growth, driven by an improvement in construction activities, such as road projects and urban infrastructure projects.

India has witnessed two consecutive years of weak monsoons, which has had a negative impact on rural demand. India’s leading meteorological agencies – IMD and SkyMet have both forecast above-average monsoons in 2016-17. This will help revive rural consumption and support agri-based industries.

According to leading job portal Naukri.com, hiring in March 2016 has surged by over 22 per cent over last year, mainly driven by IT software, ITeS, telecom, banking and insurance. This follows a strong growth of over 18 per cent in February 2016.

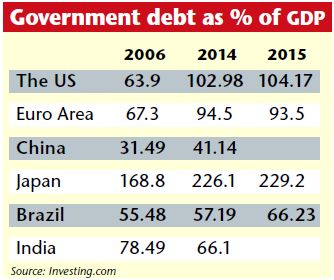

India is one of the few large global economies, where government debt as a percentage of GDP has fallen since 2006.

On the negative side, highly levered balance sheets of large corporates from the stressed sectors continue to remain a drag. The ongoing clean-up of books by public sector banks and lower commodity prices should keep earnings of PSU banks and mining and metal companies under pressure.

The risks from the ongoing global slowdown and uncertainties are still not fully mitigated, affecting investment flows and India’s external sector. While India’s trade deficit narrowed to over a five-year low in March 2016, exports fell by 5.5 per cent, declining for the 16th straight month. India’s services exports fell by 12.6 per cent in February 2016.

On valuations, Indian markets are trading just above long-term average multiples, but on highly suppressed earnings base. As corporate earnings pick-up, markets will start looking inexpensive on forward earnings. Another valuation metric of ‘market cap to GDP’ is still at an attractive level of ~65 per cent, even after the sharp rally of over 1000 points on the NIFTY50 from February lows. This shows tremendous potential for Indian markets to move up as global uncertainties subside and earnings pick up.

On a technical basis, the NIFTY50 has just closed above 200 DMA, which stood at about 7875. It needs to be seen if markets can sustain and trade above these levels and break the range on the upside going forward. It is time to remain fundamentally bullish, in an otherwise technically cautious Indian markets.

This article was originally published in Business India Magazine.

Write to us at news@valuelineadvisors.com

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.