Markets still follow FII flows.

There are multiple factors affecting equities. Markets are driven by fundamentals of economy, backed by quality of corporate earnings – but there are many other factors which affect the markets. Liquidity is one such key factor. Since the beginning of 2016, there was constant outflow of global liquidity from the risk asset class such as equities, which resulted in sharp corrections in global equities.

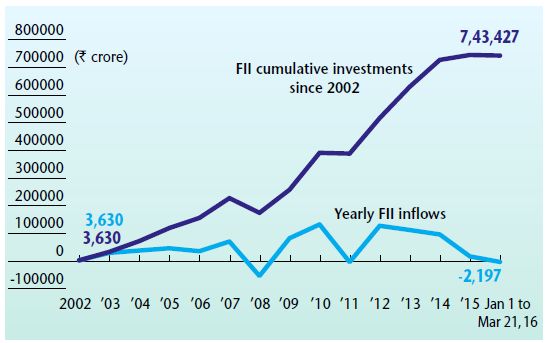

Since mid-1990s, when India opened its financial markets for foreign investors, FIIs had started investing into Indian markets. The inherent size and growth potential of the Indian economy had attracted FIIs to Indian equities. FIIs have now increased their exposure to equities multifold over past 14 years, cumulatively investing Rs7.4 lakh crore in Indian equities since the beginning of 2002.

It is also noteworthy that in the past 14 years since 2002, FIIs have remained net sellers in only two calendar years – in 2008, at the peak of US sub-prime crisis, and, in 2011, at the time of euro zone debt crisis. These events have disturbed the equilibrium of financial markets and have adversely affected global growth prospects.

Despite the drastic improvement in macros, FIIs have sold Indian equities worth Rs33,000 crore since May 2015. The year of FII outflows generally marks the bottom of a major corrective phase for Indian equities and is usually followed by 2-3 years of strong inflows, bringing strong momentum in equities. The negative FII flows over the past 12 months have increased the possibility of higher inflows in the years to come.

Indian markets attract a certain portion of FIIs’ Emerging Market allocations. Over the years, with the increase in FII participation, Indian markets are now highly correlated with other global markets. Global events have significant impact on the flows into Indian markets. In this era of global uncertainties, where many emerging economies are struggling to survive, India is one of the few large emerging economies, which is walking the credible path of fiscal consolidation amid various challenges and still growing at a respectable rate. This is despite the fact that large number of Indian corporates are struggling with broken balance sheets amidst a weak global environment.

There is a possibility that Indian markets may be adversely affected by the global headwinds in the short term but, once these headwinds subside, the real potential of the Indian economy will be unleashed, driving the markets up.

Since the beginning of this calendar year till end of February, Indian equities were under tremendous pressure, in line with other global markets. The risk-off trades in the global markets resulted in NIFTY 50 correcting by 15 per cent from 7900 at end of December 2015 to 6900 at the end of February 2016. FIIs’ net sale went over Rs16,600 crore in January-February 2016. However, since the beginning of March, post credible budget announcements, markets have sharply turned around, rising by over 10 per cent in just 14 trading sessions. In March itself, the FIIs have invested over Rs14,400 crore ($2.1 billion) in Indian equities, which is the strongest monthly flow in last 24 months. Historically, it is seen that, whenever FIIs go on a buying spree, the markets go up. Whenever global liquidity is ample, equity markets tend to outperform.

Despite the multiple steps taken by the regulators and domestic institutional players to impart investor education and strengthen financial markets, domestic savings are still not meaningfully getting channelised into equities to counter FII flows. A share of domestic investors, especially the retail segment, has traditionally remained abysmally low. Indian markets, even after two decades of liberalisation, still continue to depend on FII flows.

India is one of the few countries which is in the process of unleashing the growth in a credible manner. It is just a matter of time before the Indian economy starts showing its momentum. The 10 percent move since the beginning of March 2016 is just a partial recovery of the sharp fall of the past few months. Indian equities still have a long way to go.

This article was originally published in Business India Magazine.

Write to us at news@valuelineadvisors.com

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.