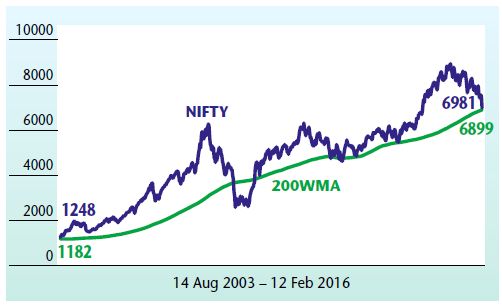

NIFTY 50 to hold 200 WMA at about 6900

Technical analysts track various moving averages to gauge market trends across different time frames. These moving averages have high relevance, as these are tracked by a high number of market participants. Just as a 200-day moving average (200 DMA) is used to gauge the intermediate trend of stocks or indices, the 200-week moving average (200 WMA) is tracked closely, as it is the deciding factor between a bull and a bear market. This level is considered very strong support and hence is the mother of all moving averages.

Historically, it is seen that the NIFTY tends to take support and resume its upward journey from near 200 WMA, which currently stands at about 6900. On 12 February 2016, the NIFTY made intraday lows of 6869, before closing at 6981, just above this magic level. Since August 2003, the NIFTY has decisively closed below 200 WMA only on two occasions – one at the time of the Lehman crisis in October 2008, when it fell another 30 per cent after a breach of the 200 WMA (it took 33 weeks to regain that level again); and second in November-December 2011, when markets traded just below the 200 WMA for four weeks before resuming its upmove.

The NIFTY has been trading in the downward sloping channel since March 2015, when it hit an all-time high of 9119 on 4 March 2015. Since then, the overall trend has remained weak. Foreign portfolio investors have turned net sellers in equities as a part of a global ‘risk-off’ strategy. The turbulence across global markets has resulted in foreign investors turning cautious on emerging markets. Equities across the globe are facing multiple headwinds.

The slowdown in China has adversely affected demand for metals, mining, and industrial commodities. The risk of a sharp devaluation of the Chinese Yuan and the fear of a hard-landing of Asia’s largest economy is creating panic in global markets. The geo-political tension in Syria, North Korea, Russia, etc, is causing further damage to investor sentiment.

After the first interest rate hike by the Fed in December 2015 – after seven years of financial crisis – investors fear this trend is likely to continue. This is adding to uncertainty, resulting in an outflow of funds from the ‘emerging markets’ to the US.

The sharp fall in oil prices has resulted in tremendous stress on the finances of countries dependent on oil & gas exports. This has forced sovereign funds to redeem funds from equity markets.

One can understand the stress for oil exporting countries, but for oil importing countries like India, this correction in oil price has come as a blessing in disguise. This booty of $70-80 billion has come at a time when India is struggling to finance its deficit – India’s current account deficit has now fallen to 1.6 per cent of GDP in the September 2015 quarter from all time highs of 6.7 percent of GDP in December 2012 quarter.

Indian finances and macro indicators are clearly on a mend. But there are no signs of pick up in corporate earnings, which is adding to the pressure on markets. Capacity utilisation continues to remain subdued and corporates are deferring capex. Large corporates, especially in the infrastructure sector, are struggling with broken balance sheets and poor cash flows, leading to defaults and restructured loans. Public sector banks are plagued with huge bad debts. The RBI has directed these banks to aggressively clean up their balance-sheets by March 2017. About 25 banks have together written off over Rs25,000 crore of loans in 3QFY16.

While the NIFTY has fallen by over 1000 points (12.3 per cent) since the beginning of 2016, mid-cap and small-cap stocks have seen precipitous falls. The retail segment, which returned back to equities, has again borne the brunt of this correction, resulting in an exodus from the markets. Investors are now shying away from making fresh investments even at these distressed levels. Pessimism is at its peak. These are signs that markets are most likely in the process of forming a major bottom. This time again, the 200 WMA should come to the rescue of markets. Remember, the best returns are made on the investments made during times of peak market turmoil.

This article was originally published in Business India Magazine.

Write to us at news@valuelineadvisors.com

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.