As ratio of Bank Nifty to CNX IT nears 2, buy CNX IT and short Bank Nifty

Long short paired trading strategy is a hedging strategy, in which the investor goes long in one scrip and at the same time goes short in the other scrip to minimise risk by hedging the position. The investor goes long in the script he is more bullish on and creates shorts position in the other one to hedge his position. For the perfect hedge trade, the size of both the positions should be identical.

This strategy is often used by hedge funds to maximise returns on their investments by entering into paired trades. The strategy yields positive returns, when the long position outperforms the short absolutely or even relatively. By adopting this strategy, the investor minimises his exposure to the broader market and profits from the change in the spread between two scrips. It can be applied to stocks as well as broader indices.

Last year, in Business India, dated 28 October-10 November 2013, this hedging strategy involving CNX Bank Nifty and CNX IT Index was discussed. At that time, CNX Bank NIFTY was quoting at around 1.21 times the CNX IT Index. CNX Bank Nifty was quoting at 10809 and CNX IT index was quoting at 8915.

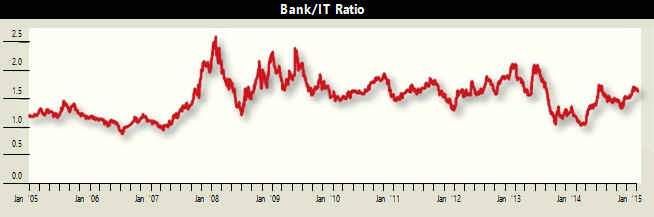

The analysis of a 10-year data, shows that this ratio has ranged broadly between 1.0 and 2.0 for about nine times out of 10, breaching this range only 10 per cent of the time. It has remained outside this range only for a brief period of time. Looking at this, it would be worthwhile to go positionally long in CNX Bank Nifty and create short positions in CNX IT, when the ratio nears 1.0. Similarly, as the ratio nears 2.0, investors should consider going long in CNX IT and short on Bank Nifty, creating a positional hedged pair position.

Since October 2013, the ratio bottomed out at about 1.03 levels on 30 January 2014, at the lower end of the broader range. Since then, the ratio has steadily moved up touching highs of 1.75 on 19 May 2014. This shows that the CNX Bank Nifty has outperformed CNX IT between 30 January and 19 May 2014. The ratio is now quoting at around 1.63. The outperformance of the Bank Nifty is expected to continue for a while.

In India, inflation is under control and a sharp fall in crude prices will further help in keeping inflationary pressure under check. The government is working towards improving its finances and restoring economic growth by starting fresh investment cycle. Lower crude prices have come as a blessing in disguise, as it will provide flexibility in budget and fiscal management for the government. Looking at the macro situation, RBI may sooner or later start cutting interest rates to support growth.

Investors are anticipating big bang reforms and positive announcements from the new government in the forthcoming budget. With the fall in interest rates and pick-up in investment cycle, interest-rate-sensitive sectors, such as banks, may continue to outperform defensive sectors, such as IT, in the near term.

As CNX Bank Nifty rallies further and the ratio of CNX Bank Nifty to CNX IT moves closer to 2.0, investors can positionally enter in to this pair trade, by going long on CNX IT and shorting Bank Nifty. In this trade, the investor earns positive returns if CNX IT outperforms Bank Nifty over a period and ratio declines steadily from 2.0.

This article was originally published in Business India Magazine.

Write to us at news@valuelineadvisors.com

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.