But may not have material impact on Indian markets

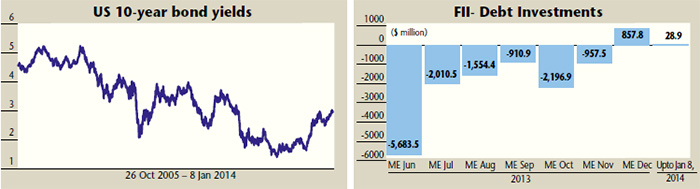

The 10-year US bond yields have been rising since May 2013 when the US Fed announced its intention to taper, suggesting a revival in the US economy. Since then the yields on 10-year US bonds hardened from 1.6 per cent at the beginning of May 2013 to around 2.6 per cent by November 2013.

On 17 December 2013, the US Fed announced its much anticipated very modest taper of $10 billion per month of bond purchases beginning January 2014. The recently announced economic data also suggests better-than-expected economic recovery in the US, further driving 10-year US bond yields to around 3 per cent, the highest levels since July 2011. The US economy seems to be on the mend and the rise in bond yields have given shivers to the investors of various emerging markets including India.

Market participants fear that constantly rising US bond yields would trigger a hardening of interest rates in India as the country is in desperate need of foreign investments to fund its current account deficit (CAD). The Reserve Bank of India may be forced to raise interest rates, despite a slowing economy, to attract foreign funds, thereby delaying India’s economic recovery. The rise in US bond yields may result in an outflow of foreign liquidity from the Indian markets to US debt.

The US economy is still in the early period of recovery. The strength of recovery is not strong enough to drive yields substantially higher from the current levels. The US Fed has estimated that the economy will grow between 2.8 to 3.2 per cent in 2014 as against 2 per cent in 2013. Even with tapering of bond purchases, the Fed has made it clear that it plans to continue with near zero per cent short-term rates at least until the unemployment rate falls below 6.5 per cent to support economic growth.

We believe that the major impact of tapering of bond purchases by the Fed and the corresponding rise in the US bond yields on Indian markets has already happened during past six months. The trend of re-allocation of funds from Indian markets to US debt had already begun starting the last week of May 2013. As per data published by SEBI, FIIs net sold Indian debt worth over $13 billion between June and November 2013. Despite tapering of bond purchases by the Fed in mid-December and further rising of bond yields in the US, FIIs were net buyers of Indian debt to the tune of around $900 million between December 2013 and till 8 January 2014.

The impact of tapering on the Indian currency could be limited as India is now better prepared with an improved foreign exchange reserves position and lower CAD. India has added over $30 billion to its foreign exchange reserves through opening a special concessional dollar swap window for FCNR (B) deposits and through rising exports.

While in the near term Indian markets may come under pressure due to outflow of foreign investments due to taper fear, we feel this will have a temporary impact on the markets. The improvement in the US economy will be positive for the Indian economy in the medium- to long-term as it will help India’s export-oriented sectors such as IT-ITeS, healthcare, pharma, etc, report a strong revival in earnings growth. The attractive valuations of Indian equities and the turnaround story of the Indian economy would negate the impact of rising bond yields on foreign investments. However, H1FY14 could be extremely volatile, dominated by the political developments in India. Markets will decide the broader trend after election results are announced.

This article was originally published in Business India Magazine.

Write to us at news@valuelineadvisors.com

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.