If backed by strong government policy action, the current 200-DMA is ripe for a break-out

“Many people like to buy stocks when they’ve been beaten down over a long period of time. You’ll see people ‘bottom-fishing’ stocks as they are plunging lower under their 200-day moving average… Once a stock drops under its 200-day moving average, all bets are off. It’s better to be buying stocks in a longer term uptrend than in a longer term down trend” ~ A market strategy found in Larry Connor’s book: Short Term Trading Strategies That Work.

As an age-old indicator, globally as well as on the domestic scene, the 200-day moving average (200-DMA) of a market barometer – an index – has been used as an indicator for investors to bet on a change of trend in the stock market. Right now, the 200-DMA of the National Stock Exchange’s (NIFTY) 50, which is an index computed from performance of top 50 stocks from 24 different sectors listed on NSE and a fairly broad representative of the Indian market, is in the breakaway orbit.

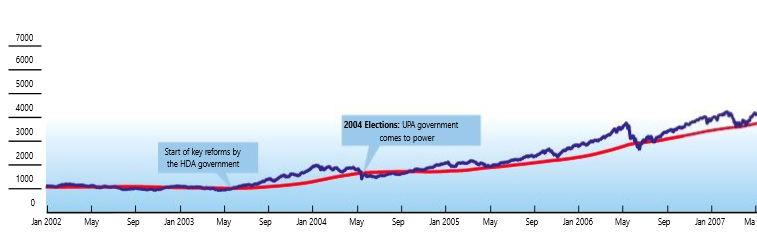

Step back to understand this phenomenon and how, in the last decade, when the 200-DMA broke, it has led to a change of trend in the mar- ket. However, this has been combined by major government policy action (see chart).

First, in June 2003, the markets broke above this indicator, decisively after being sideways with downward bias for about three to four years, indicating major trend reversal. This was supported by major reforms by the government, especially in the infrastructural and power sector. The markets remained above the 200-DMA for almost a year till May 2004.

Subsequently, the political uncertainty due to Lok Sabha elections and change of government at the Centre led to the market falling below the 200-DMA. This fall resulted in a negative trend. However, as the UPA government successfully took charge of the economy and continued with the reforms, markets once again broke above the 200-DMA mark in September 2004. Since then, markets saw a strong sustained up-move, which was supported by sustained economic growth. The minor corrections during this up-move took support around 200-DMA, but failed to break decisively till March 2008, when markets fell below the crucial 200-DMA.

The global economic turmoil due to the US subprime crisis and the collapse of Lehman Brothers and others hit the Indian markets hard and the 200-DMA took a beating. The fall led to major change in trend and the markets remained in the downward trend below the crucial mark for almost a year. Markets finally broke out of the downtrend in March 2009 when the UPA returned to power.

By end April 2009, markets had managed to close decisively above the 200-DMA, which resulted in a change of trend. The optimism in the form of expectation of continuation of reforms kept markets in the positive territory till early 2011.

Then, as news of corruption and scams took centre stage, in February 2011, markets fell below the 200-DMA NIFTY. This was fol- lowed by the nation-wide uproar, led by social activist Anna Hazare, to bring in a strong Jan Lokpal Bill, an anti-corruption legislation. This resulted in a complete halt in the decision-making of politicians, leading to delays and policy impasse. The rise in domestic inflation, worsening fiscal situation and weakening rupee were followed by aggressive monetary tightening by the Reserve Bank of India. The European debt crisis also did no good to the investors’ sentiments. All these events shook the investors’ confidence. With the passage of time, the economy too started slowing down.

Some parties in the UPA and the Opposition opposed the strong policy reforms. All these kept markets under pressure and below the crucial 200-DMA. Several attempts by the market to move above 200-DMA were followed by aggressive selling by the investors.

Finally, with some flow of liquidity from the FIIs during the first quarter of 2012, the markets finally managed to close above 200-DMA in January 2012. The liquidity flow kept markets above the 200-DMA mark and that brought in optimism among the investors. However, as the liquidity dried down and, with the absence of indication of positive reforms from the government, markets again fell below 200-DMA in May 2012 and stayed weak for short time.

Amid economic slowdown and notwithstanding the political compulsions, Manmohan Singh’s decision to take over the charge of finance ministry got the markets excited. The positive signals from the PMO have kept the markets a tad above the 200-DMA mark.

Finally, looking into the past, it is the government’s policy action that will decide whether this time around the breach of 200 DMA mark will result in the major change of trend in the market.

Will history repeat itself?

This article was originally published in Business India Magazine.

Write to us at news@valuelineadvisors.com

Disclaimer: The views expressed in this article are personal and the author is not responsible in any manner for the use which might be made of the above information. None of the contents make any recommendation to buy, sell or hold any security and should not be construed as offering investment advice.